EV Chargers

EV Chargers

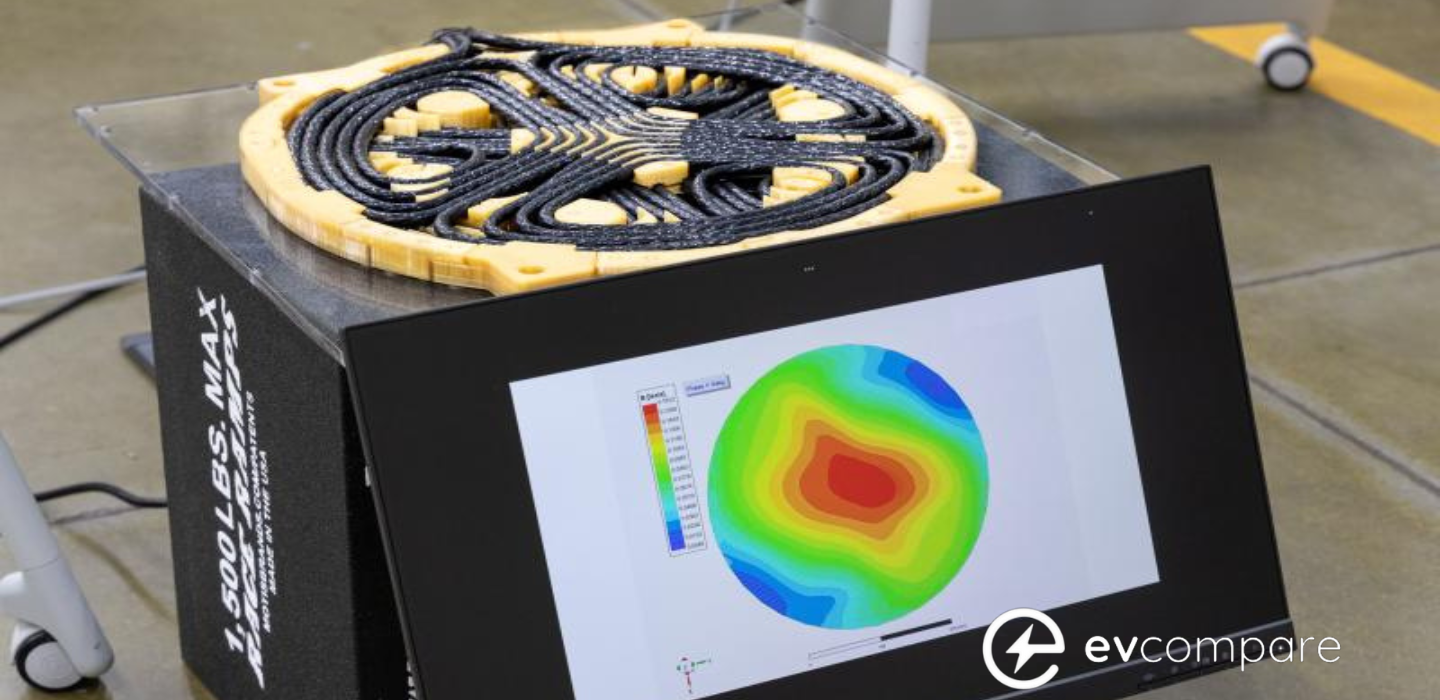

Scientists Reveal Breakthrough: New Wireless EV Charger Matches Speed of Superfast Wired Plugs.

In a groundbreaking development, scientists have unveiled a cutting-edge wireless charging system capable of delivering electric vehicle (EV) batteries with […]

EV Chargers

The Growing Availability of Used EVs: A Practical Guide for Australian Buyers

The adoption of electric vehicles (EVs) in Australia has experienced a significant surge over the past year, driven by the […]

EV Chargers

Lotus Unveils Ultra-Fast EV Charging Network to Compete with Tesla

In a bold move to rival Tesla’s Superchargers, Lotus is set to launch its own high-speed charging network across China, […]

EV News

EV News

BYD Unveils 2024 Plug-In Hybrid Ute

BYD has recently unveiled a series of official camouflage images of its highly anticipated ute, providing enthusiasts with a clearer […]

EV News

Electric Car Ownership Boom in Aussie Outer Suburbs for Savings

Electric car ownership in Australia’s outer suburbs is surging, contrary to prevailing beliefs that it’s a trend confined to inner-city […]

EV News

2024 Chery Omoda E5 Aims to Make a Mark in Australia’s Electric Vehicle Market

Chinese automaker Chery is gearing up for the Australian debut of its inaugural electric vehicle, the 2024 Chery Omoda E5 […]

EV Review

EV Review

Savic Motorcycles – Rubber to Road at Phillip Island

In a groundbreaking leap towards sustainable transportation, Savic Motorcycles is set to make history with the launch of their highly […]

EV Review

Elon Musk Unveils Tesla Cybertruck with Bold Claims at Austin Event

Tesla CEO Elon Musk took center stage in Austin, Texas, to reveal new details about the highly anticipated Cybertruck, one […]

EV Review

Renault Unveils Affordable Next-Gen Twingo as Electric Game-Changer

Renault has provided a glimpse into the future with the reveal of the next-generation Renault Twingo, positioning itself as one […]

Finance

Finance

Surge in EV Business Finance Signals Growing Demand, NAB Reports

In a remarkable development, NAB’s finance for electric vehicles witnessed an astounding surge of 224% in the bank’s latest financial […]

Finance

Australia tightens efficiency rules for luxury car tax exemptions

In a recent move, the Australian federal government has bolstered the momentum for electric vehicles (EVs) by introducing significant changes […]

Finance

A Few Bad Quarters Won’t Derail the EV Revolution

If you entered 2023 expecting a smooth and uninterrupted rise of electric vehicles (EVs), you might be questioning your whereabouts […]

Tips & guides

Tips & guides

A Beginner’s Guide to Electric Vehicles: The Road to a Sustainable Future

Understanding Electric Vehicles In a world increasingly concerned about sustainability and environmental impact, electric vehicles (EVs) have emerged as a […]

Tips & guides

Hybrid Finance – Accelerating Electric Vehicle Adoption

Introduction: In recent years, electric vehicles (EVs) have gained significant popularity as eco-friendly alternatives to traditional gasoline-powered cars. However, the […]

FAQ

We’ve compiled a list of common inquiries to provide you with quick and informative answers.

Most car loans are secured. With secured car loans, the loan will typically be secured by the vehicle you are purchasing. This means that the lender can repossess your car and sell it if you don’t repay the loan on time.

An EV loan, or Electric Vehicle loan, is a specialized financing option designed to help individuals purchase electric cars. Unlike traditional car loans, EV loans are tailored to the unique characteristics of electric vehicles. They offer competitive interest rates and extended repayment terms, making it more affordable for buyers to transition to eco-friendly transportation. The loan process involves applying for financing, getting approved based on factors like credit score and income, and selecting a suitable repayment plan.

Most car loans are secured. With secured car loans, the loan will typically be secured by the vehicle you are purchasing. This means that the lender can repossess your car and sell it if you don’t repay the loan on time.

Most car loans are secured. With secured car loans, the loan will typically be secured by the vehicle you are purchasing. This means that the lender can repossess your car and sell it if you don’t repay the loan on time.

To be eligible for an EV loan, lenders typically consider factors such as credit history, income stability, and debt-to-income ratio. A good credit score, often above 650, is advantageous. Lenders may also require a consistent source of income and proof of employment. Meeting these criteria increases the likelihood of approval for an EV loan and favorable interest rates.

Yes, many lenders offer incentives and special rates for EV loans to encourage environmentally friendly choices. These incentives may include lower interest rates, reduced fees, or extended loan terms. Additionally, some regions offer government subsidies or tax credits for purchasing electric vehicles. It’s recommended to explore these incentives and compare loan offers to maximize savings.

When comparing EV loan options, consider factors like interest rates, loan terms, and associated fees. Look for transparency in terms of monthly payments and the total cost of the loan. Evaluate the lender’s reputation, customer reviews, and their experience with EV financing. Online loan comparison tools and financial calculators can assist in comparing offers and identifying the most suitable option.

If you wish to upgrade your EV before the loan term ends, options are available. You can explore refinancing your existing loan to incorporate the new vehicle’s cost. Alternatively, trading in your current EV and applying its value towards the new purchase is an option. Be sure to review any prepayment penalties or refinancing terms to make an informed decision that aligns with your financial goals.

Looking for the best car loan?

Here at EVCompare we are access to the best EV (electric vehicle) lenders in all of Australia

Pepper Money

Realize your dream of owning a green car with Pepper Money EV Car Loans. Pepper Money offers a comprehensive range of low-interest rate options designed to meet your financial needs.